- Mutlu Yaşam Alanları Sunuyoruz!

- +90 224 248 56 66

- info@dumanlargroup.com.tr

twenty five Roslyn Path, initial Floor, Mineola, New york, 11501

Finest wild panda casino login uk Black-jack Web sites for 2024 Casinos on the internet which have Blackjack

28 Aralık 2024Finest online double double bonus poker 100 hand habanero real money Online casinos NZ 10+ Finest Real money Websites

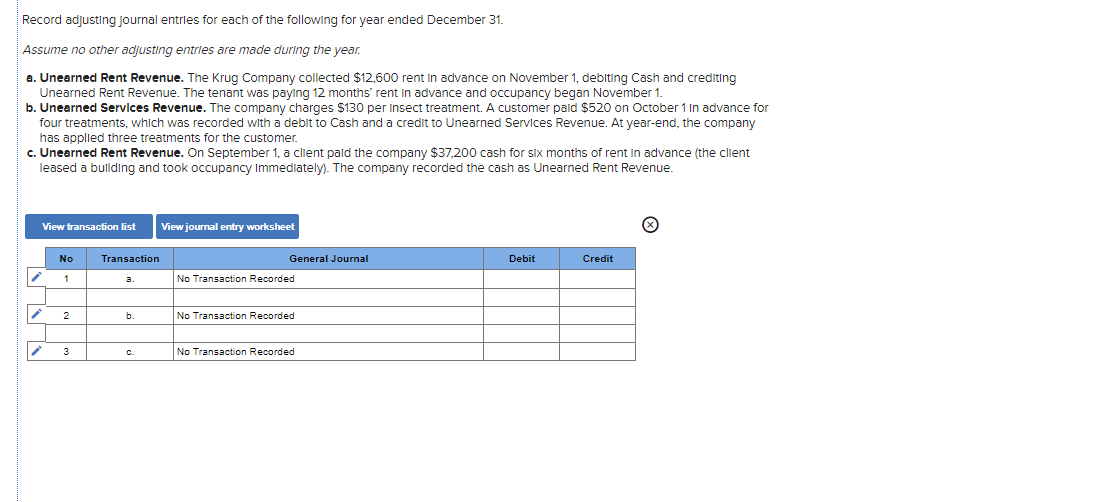

28 Aralık 2024Just how to mention mortgage issues from the switching the house or property Really worth?

Change to your Value of could change the contributes to a extreme means. Lendersa sliders allows you to make fast changes to explore their funding choices.

- Go into the Amount borrowed yourself in the Amount borrowed box.

- Go into the Cost by hand in Value of container.

You could replace the worth of of the swinging the house Value slider upwards or down or from the entering a separate Worth of by hand regarding Value of package.

Once you alter the Property value, just the LTV varies, and also the Loan amount will stay a similar Amount borrowed.

How-to discuss loan scenarios from the changing the mortgage Amount?

Transform toward amount borrowed, but somewhat, you will definitely replace the results in a significant means. Lendersa sliders allows you to generate fast alter to understand more about your investment choice.

- Go into the Loan amount yourself from inside the Amount borrowed box.

- Enter the Cost manually into the Property value container.

- There’s two an effective way to alter the Loan amount to the sliders:

Alter the Amount borrowed because of the moving the mortgage Amount slider. (The new LTV may differ, in addition to Worth of will stay intact).

Tips speak about loan problems by switching the LTV Slider?

LTV ‘s the acronym out-of Mortgage To Well worth, and it is the new proportion within Amount borrowed as well as the Value of. The new algorithm to estimate LTV is Amount borrowed split up because of the worth of.

Changes towards the LTV, nevertheless some, you can expect to replace the causes a life threatening means. Lendersa sliders will let you build punctual change to explore the financing options.

- Enter the Loan amount yourself inside Amount borrowed container.

- Enter the Price by hand within the Value of package.

- You’ll find three straight ways to evolve the latest LTV:

Alter the Amount borrowed of the swinging the borrowed funds Count slider. (New LTV varies, in addition to Worth of will remain intact).

Lendersa State-of-the-art Calculator

Brand new Demo calculator therefore the Hard Money Calculator give you an effective general guess to the types of fund you may expect to help you get. The next phase up are Lendersa State-of-the-art Calculator, the ultimate lending calculator and you may a quantum lip more any other home loan calculator available.

Lendersa State-of-the-art Calculator is more diverse and you will powerful as compared to Tough Currency Calculator, and also the Demonstration Calculator. It includes most of the data fields needed to dictate their eligibility when it comes to loan.If you’re not yes on which mortgage you can get, after that play with Lendersa State-of-the-art Calculator rather than the Difficult Money Calculator. Begin by entering the brand of property as well as your area code and then click the fresh new Discuss The choices button.

- Traditional?

The advance calculator allows you to use Lendersa LoanImprove motor to maximize the loan request very even more lenders would want so you can vie with the right od planning your loan.

Throughout the LoanScore

LoanScore (Mortgage Likelihood of Achievement Rating) procedures the chance to find performing loan providers who’ve matching financing programs with the debtor mortgage consult. A debtor normally discuss of many concerns and you can located several outcomes for each query with original LoanScore for every single effect. Brand new LoanScore mean towards borrower the amount and the quality of the newest loan providers who’re trying to find considering their mortgage demand. This new LoanScore results include 0 so you’re able to 99. A leading LoanScore (Age.grams., significantly more than 80) suggests many eager loan providers who are seeking planning the loan in accordance with the borrower demand. A minimal LoanScore suggests no or few lenders with a number of matching software. Lendersa financing optimisation try a proprietary processes the newest borrower is take on adjust the results from his financing request and increase LoanScore.

What is the different anywhere between LoanScore and you can Fico rating? LoanScore and you can Fico Score are completely more ratings. FICO, or Fair Isaac, credit ratings is actually an approach to quantifying and you may contrasting an individual’s creditworthiness. Credit ratings vary from 300 so you can 850. Fico Score measure your credit rating; it is based on your credit history. LoanScore (Loan Danger of Achievements Score) tips the possibility you will located loan even offers out of lenders founded on the financing consult along with your financial qualifications. This new LoanScore assortment are away from 0 so you’re able to 99. Good Fico rating generally speaking helps improve the LoanScore, however it is merely a portion of the LoanScore. You can easily has actually perfect Fico get away from 850 and you can LoanScore regarding 0; this means that regardless of the excellent borrowing, there are not any loan apps which can be matching the borrower’s means. And vice-versa, you could https://www.paydayloancolorado.net/thornton have a negative credit rating of 350 Fico and LoanScore away from 99, which will be possible after you request a loan based on security just and lenders disregard the credit history. For each and every mortgage system has its own unique LoanScore. Any time you change your loan request, the fresh programs alter, together with LoanScore of every system alter instantaneously and you will instantly the Fico get remains the same unless you by hand change it.