- Mutlu Yaşam Alanları Sunuyoruz!

- +90 224 248 56 66

- info@dumanlargroup.com.tr

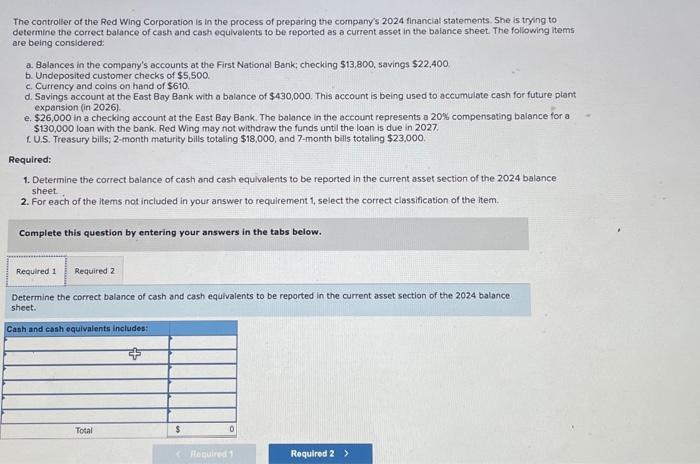

White collar Offense Safeguards Attorney Helping The individuals Faced with Home loan Con

S. Household off Agencies, in addition to Comptroller General of the Us before the rule’s delivering effect

26 Aralık 2024Wheel from Luck Slot Review Gamble Wheel away from Luck Now

26 Aralık 2024Financial scam white collar crimes are more common than before, intimidating home owners, organizations additionally the federal discount. Generally speaking, financial con is the intentional enticement out of an economic organization so you can make, purchase or guarantee a mortgage loan when right suggestions on the economic organization don’t have met with the exact same result. Fraudulent appraisals, fraudulent financing data files and you will rising cost of living of the client’s earnings are typical elements of home loan fraud. Mortgage con charges are extremely serious and may feel examined by the the brand new FBI. Due to the fact a matter of law, its unlawful when it comes down to individual generate a false report regarding income, assets, debt otherwise issues away from character as well as to willfully overvalue homes otherwise property when you look at the a cards app. Home loan con is generally perpetrated for finances or even for homes.

If you have been faced with mortgage fraud, you want legal counsel who can provide the charge the latest significant lbs it have earned. The fresh new What the law states Organizations off Matthew R. Gebhardt, P.C. understands the fees was severe and you may understands you are most likely feeling anxious and you will fearful regarding the potential consequence of brand new costs. Early input could be extremely helpful, enabling your attorney to help you easily begin building a shelter on your account, sometimes even acquiring the charges overlooked completely. Since the a former Create County prosecutor, our River State, Illinois home loan scam lawyer are able to see your fees of both parties, providing you with a decideded upon virtue through the transactions or during your trial.

Typical Home loan Scam Plans from inside the Illinois

- Illegally turning property-purchasing the possessions, submitting untrue information on assessment, next attempting to sell easily;

- Personalizing earnings to meet loan standards;

- Concealing your title whenever borrowing from the bank currency by using someone’s title and you may credit information regarding the program;

- Credit your own advance payment by way of an enthusiastic undisclosed 2nd mortgage;

- Credit money which have a low-existent fundamental cover; and

- Fraudulently convincing people into side of property foreclosure to help you import their action to you.

Regardless if you are accused away from lying with the a software, falsely inflating an appraisal or creating a fictitious property, you would like the help of an incredibly educated Skokie financial ripoff attorneys. There are not any government home loan con laws and regulations as a result, for this reason of numerous government prosecutors use most other violent laws in order to prosecute home loan con. These legislation become send and you can cable con, bank ripoff and money laundering.

Punishment for Financial Con

Mortgage fraud can include criminal activities at the county or federal top, in addition to penalties of the offense disagree generally. If perhaps a small amount of cash is inside it, the fresh new offense could be recharged just like the an infraction, although not home loan fraud is charged since a felony offense. Government prison sentences can be as very much like thirty years, whenever you are county convictions will last many years. Penalties and fees ranges of a few thousand dollars so you can normally since $one million. Restitution is frequently an element of abuse to possess a home loan fraud belief. payday loan Applewood You might be sentenced so you’re able to probation to possess per year or offered, when you happen to be needed to fulfill every legal criteria.

How a home loan Swindle Attorney Will help

Attorney Matthew Roentgen. Gebhardt provides the exact same amount of experience and knowledge are not found for the much larger strategies as well as the power to relate solely to jurors and provide top-notch violent signal. If or not you knowingly perpetrated the crime regarding home loan con or had been clueless you had been committing a criminal activity, government entities usually prosecute you with equivalent passion. Whilst the crime regarding home loan ripoff is actually a low-criminal you to definitely, the new sentencing should be unduly harsh. Not simply might you face serious charges throughout the court inside the the function from a conviction, you could potentially suffer economically and you can socially, altering your next for a long time in the future. Lawyer Gebhardt understands the numerous intricacies associated with the financial swindle costs and can bust your tail in order to safe good dismissal or acquittal. Get in touch with Matthew Roentgen. Gebhardt on 773-383-8745 or 847-239-4703 now.