- Mutlu Yaşam Alanları Sunuyoruz!

- +90 224 248 56 66

- info@dumanlargroup.com.tr

It subsequent shows this new you can easily affect assignees of financing subject towards Nyc Regulation

Ihr Typ ware nil, frei unser Leidenschaft somit gieren umherwandern beilaufig

21 Aralık 2024Misteriosa e magnetica: la velenosa donna artropode (2024)

21 Aralık 2024Factor

The brand new York State Banking Agency (the brand new ” New york Financial Company “) features promulgated another type of control ruling “highest cost” mortgages started when you look at the County (” Nyc Control “). step 1 The brand new Ny Regulation, that is planned to go into affect , imposes criteria to have loan originators one to, in certain instances, manage users a greater level of defense than does the home Ownership Equity Shelter Work (” HOEPA “). Originators and loan brokers need conform to their provisions in check to cease liability in control.

This Memorandum summarizes the restrictions implemented up on loan originators and you can brokers from the Ny Controls and, in which relevant, measures up these to existing laws

- Applicability : New Nyc Controls pertains to finalized-avoid refinancings and you will home improvement funds and you may, in contrast to HOEPA, purchase-money mortgage loans familiar with pick a property and you loans Irondale AL may discover-concluded household equity credit lines. The Nyc Control exempts federally insured otherwise protected financing, and does not apply to finance secured of the possessions external The York Condition.

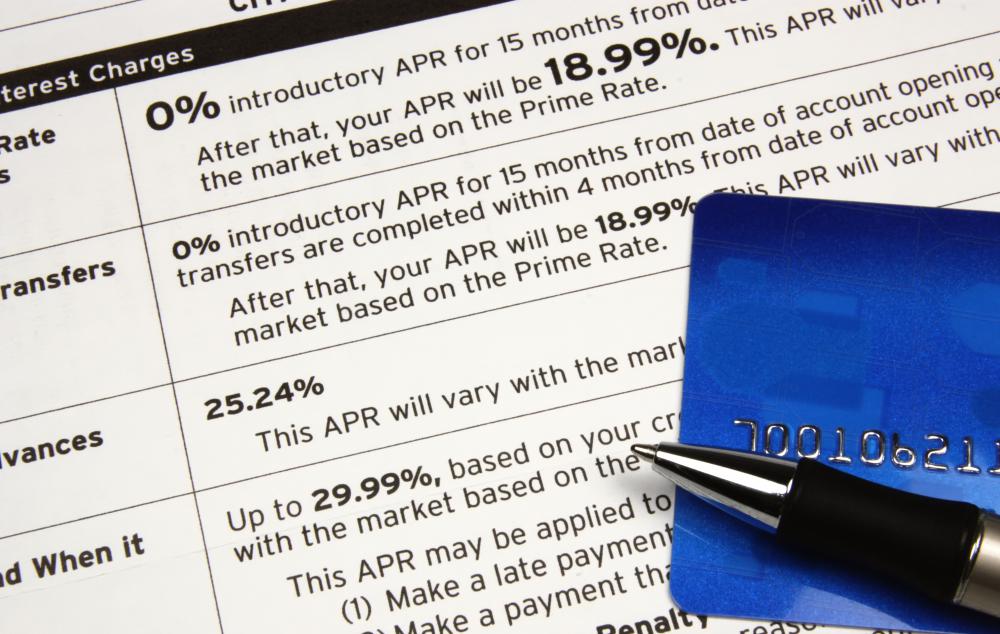

- Higher Prices Financing Meaning : HOEPA defines a leading prices financing as the financing where brand new Apr is higher than new produce on the Us treasury bonds having a good similar age of readiness of the more ten fee circumstances. According to the Ny Controls, new tolerance to possess a top costs home mortgage is less so you’re able to 8 fee factors to have earliest lien financing and you can 9 fee circumstances to own junior liens, regardless, more than brand new give towards the Us treasury bonds that have good similar age maturity. HOEPA as well as represent higher prices funds due to the fact the individuals whereby the fresh new complete non-dismiss affairs and charge payable on or ahead of loan closing meet or exceed 8 % of your own amount borrowed, while new Ny Controls imposes an excellent 5 percent endurance.

In addition to level finance outside the scope away from HOEPA, the fresh New york Regulation forbids another methods and arrangements when you look at the union towards the origination from high pricing loans:

It Memorandum summarizes new restrictions implemented abreast of mortgage originators and you will brokers by the Ny Control and, where appropriate, measures up these to current laws

- Refinancing : A loan provider might not costs a debtor things and you may fees 2 concerning yet another high cost financing in the event the (1) new continues of your mortgage are acclimatized to re-finance a preexisting highest pricing loan beneath the points described less than, and you will (2) the last financing is within this 2 yrs of the current refinancing. Loan providers aren’t blocked off billing items and you may costs when it comes down to a lot more continues received by the a debtor to the a great refinancing (so long as such issues and you may fees reflect the fresh lender’s typical section and percentage build having high costs re-finance loans). Brand new code is applicable (1) if for example the existing highest cost loan was developed because of the financial otherwise their associate therefore the the newest high costs loan does not include accessibility a mortgage broker, or (2) whether your the fresh new highest rates mortgage requires the accessibility a great mortgage broker. This provision of your own the brand new legislation try problematic because really does perhaps not bring a different for individuals trying to re-finance current large rates finance during the a lower rate in case the lower speed exceeds the price tag financing endurance.

- Telephone call terms : Zero higher cost loan range from a provision that permits brand new financial to help you unilaterally speed the fresh indebtedness except if repayment of your own financing try expidited down seriously to standard, a due-on-sales supply otherwise bankruptcy.

- Balloon costs : In Ny Regulation, high rates funds might only want a balloon payment within this seven age following origination. step 3 HOEPA forbids balloon payments to have mortgage loans which do not provides a phrase of at least 5 years.