- Mutlu Yaşam Alanları Sunuyoruz!

- +90 224 248 56 66

- info@dumanlargroup.com.tr

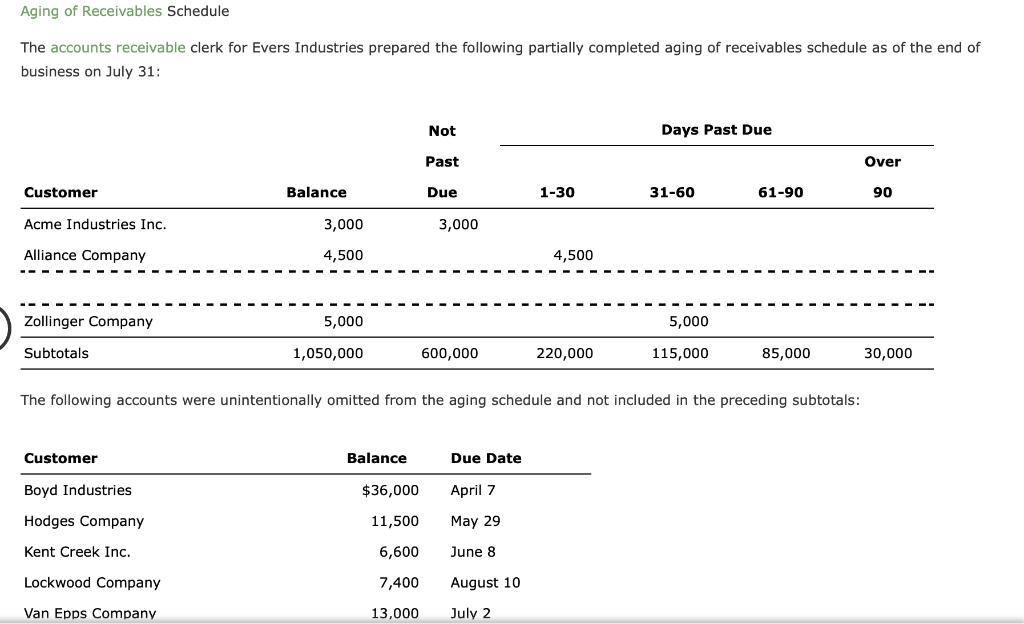

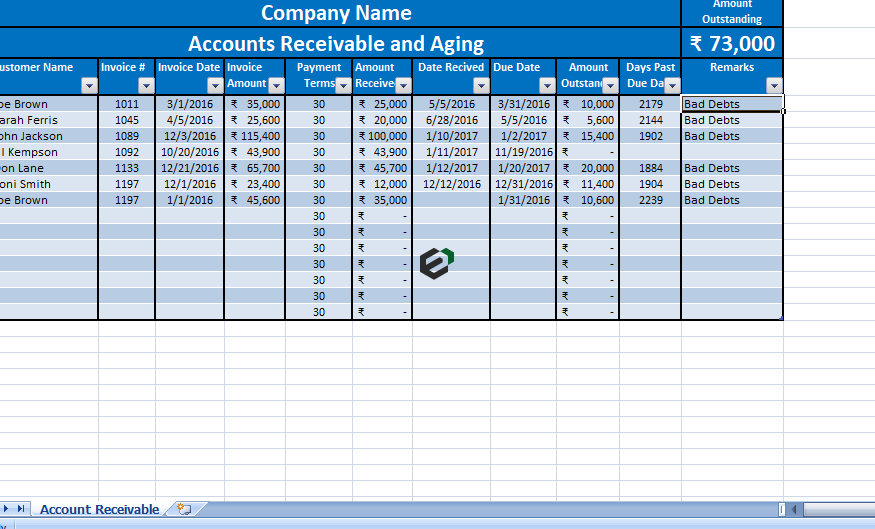

Accounts Receivable Aging Report: Importance, How to Create & Use It

HILAX Dividend History, Dates & Yield

24 Mayıs 2021Бокс: известны прогнозы букмекеров на реванш Усик Фьюри Новости на Gazeta ua

1 Temmuz 2021

In this article, we will comprehensively cover everything about accounts receivable aging reports. We will explain their purpose, why they are crucial, and how to create them. Use the report to organize and filter out the customers that owe you the most and whose payments have been overdue for a long time.

Treasury & Risk

According to research conducted by Tide, 16% of small business invoices are paid late. When payments are repeatedly not made on time, it leads to awkward conversations with customers, cash flow problems, increased payment recovery costs, and more. The typical column headers include 30-day windows of time, and the rows represent the receivables of each customer. Cash flow is important to a business because many businesses fail due to negative cash flow. That’s why tracking the cash flow is a crucial element of maintaining a healthy and successful business.

Aged Receivables Report

An aging report helps businesses manage their accounts receivable by categorizing outstanding invoices based on their due dates. It identifies overdue accounts, prioritizes collection efforts, assesses the effectiveness of credit policies, and provides insights into cash flow and potential bad debts. This schedule ranks each customer based on their total balance and outstanding balance and calculates an estimated percentage of uncollected accounts receivable as well as the total of bad debts. By keeping an aging schedule, firms can easily find out which customers are paying their bills in due time and which customers are less reliable, thus adjusting their credit policies.

Gather unpaid invoices

For example, there are fewer receivables in the aging report created before the month-end, but there are more receivables payments for the company. The company’s management should match their credit terms with the periods of the aging report to get a clear picture of the accounts receivables. Generally, the longer the account balance is overdue, the more likely it will be uncollectable and will lead to a doubtful debt. Therefore, many firms create an aging schedule of accounts receivables to follow the pattern of collecting their account receivables and track the percentage of doubtful debts. Businesses can use accounts receivable aging to decide whether to continue doing business with a certain customer or whether to require them to pay in advance or in cash.

Comparison of Percentage of Net Sales Method and Aging Method

- Sum the amounts for each category to see the totals for each aging period.

- The accounts receivables aging method categorizes the receivables based on the range of time an invoice is due.

- Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

This way, they can adjust how much debt they can afford to go uncollected. Next, you’ll want to group each of the customer’s invoices according to the aging schedule. For example, if the invoice was due on the 15th and it’s now the 22nd, the invoice is seven days past due. The report typically divides receivables into time periods, such as 0-30 days, days, and days past due.

Accounts receivable aging schedule illustrated

Identifying these late payments can help you prioritize collection efforts and identify recurring patterns. If certain clients often pay invoices late, consider renegotiating payment terms or reviewing your credit policies. An aging schedule is a financial statement that categorizes a company’s accounts receivable based on the length of time the receivables have been outstanding.

Overdue amounts attributable to a number of customers may signal that your business needs to tighten its credit policy toward new and existing customers. If a large amount applies to a single customer, the company should take the necessary steps to collect the customer’s due payments soon. When there are customers with overdue amounts beyond 60 days, it is required to tighten the credit policy.

Following the insights you glean from your accounts receivable aging report, managing bad debts and maintaining a clear allowance for doubtful accounts enhances your financial stability. By calculating bad debts accurately, you can anticipate and manage losses. Proper allowances what’s the difference between amortization and depreciation in accounting also give you an accurate picture of expected cash flows. In this article, we present how accounts receivable aging helps you understand which invoices are most overdue. Classifying accounts receivable also helps you identify which invoices need attention for collection efforts.