- Mutlu Yaşam Alanları Sunuyoruz!

- +90 224 248 56 66

- info@dumanlargroup.com.tr

The great benefits of Providing a house Guarantee Line of credit which have Mutual off Omaha

Security Problems With Xl-3

9 Aralık 2024Highest inflation memories affect All of us consumers’ outlooks

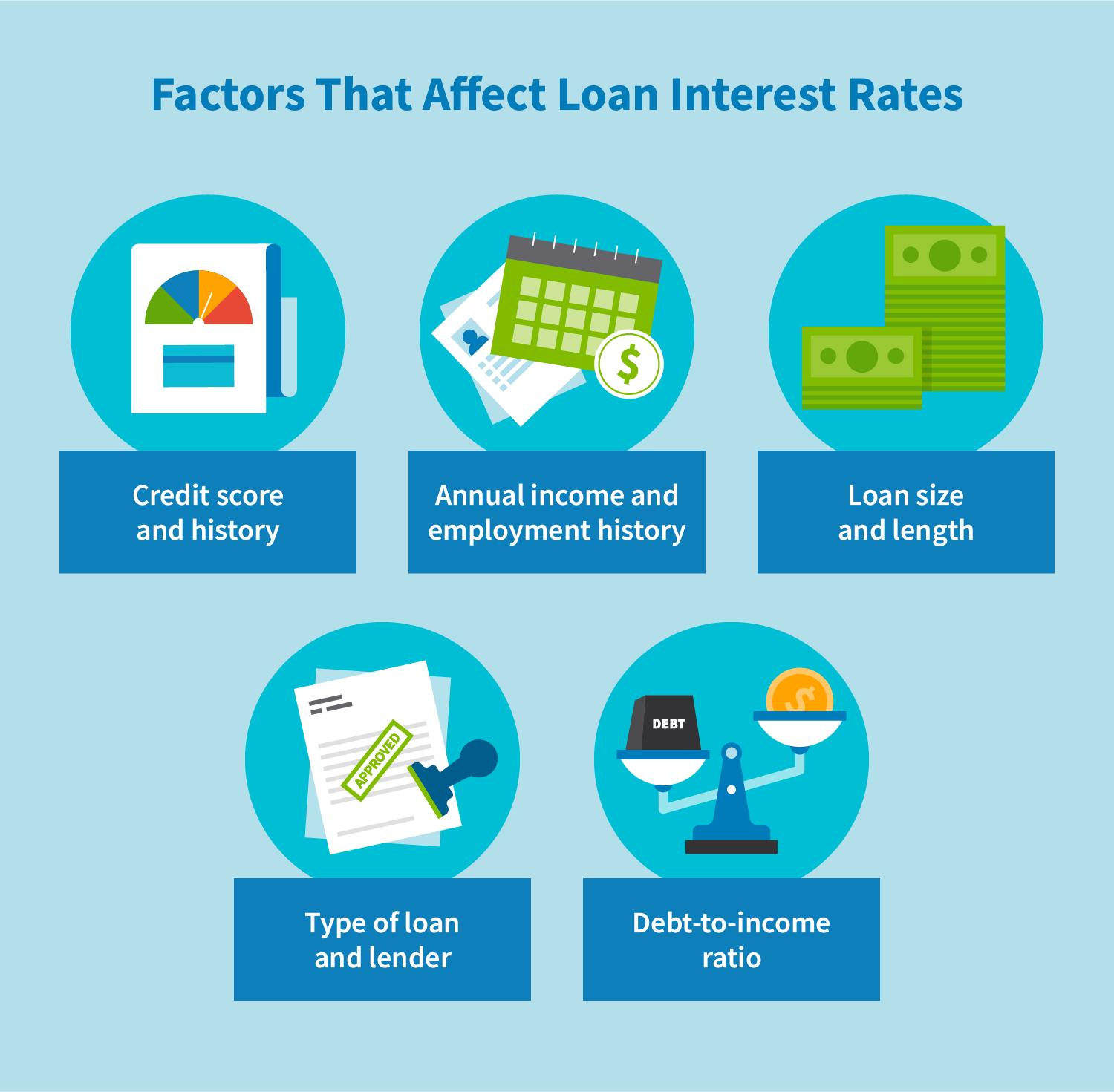

9 Aralık 2024To start the application process that have Common from Omaha Financial, you will need to collect requisite data particularly evidence of income, financial comments and details about your house. This type of documents assist Shared regarding Omaha Home loan influence their eligibility and you will the amount of credit your be eligible for. Think of, good credit and you may a decreased debt-to-income proportion replace your probability of acceptance.

Upon recognition, you are available with a borrowing limit that you could availableness in draw period, which usually lasts about 5-10 years. It draw period permits you self-reliance from inside the determining simply how much your want to obtain at the a given some time what you should use they getting. Your payments inside the draw months have a tendency to feature notice-just, making it less costly.

Adopting the draw period closes, you enter the cost months, that will last around twenty years. During this time period, you will need to pay off both the dominant and attention toward the balance your utilized. Remember that HELOCs typically have varying interest levels, which means that your monthly payments can transform through the years.

- Flexibility: You can acquire exactly what you need since you need they, resulted in all the way down rates versus other designs of borrowing. So it number of control allows you to use your savings in a way that serves your position most useful.

- Sleek Application Techniques: The application procedure with Mutual from Omaha is actually streamlined and you can transparent. We offer obvious guidance into the records and requirements needed so you can qualify for a great HELOC, ensuring you have got a softer lending feel.

- Access to Money: Common of Omaha Home loan is continuing to grow the financial planning functions in order to were family security study. This specific approach makes you influence its expertise so you can smartly use your household guarantee into the huge context of your monetary desires.

What can You utilize the money from property Security Range regarding Borrowing of Common from Omaha Having?

Common out-of Omaha Financial cannot demand spending limitations to the HELOCs. You have access to fund for a few intentions, in addition to renovations, debt consolidating, academic expenditures, scientific costs, and you can major sales. Always have a look at your debts to make advised choices in order to make sure you’re utilizing your HELOC sensibly.

Who’s Qualified and What do You ought to Apply?

So you’re able to qualify for a property security loan or credit line, you usually should have a large amount of equity inside the your residence.

- Proof Earnings: Complete recent pay stubs, W-2s, otherwise taxation statements to confirm your monthly money.

- Credit history: A strong credit history (generally 620 or higher) often is necessary for loan providers. Check your credit history to make certain their reliability before you apply.

- Home Assessment: An assessment out of a licensed top-notch determines the current market price in your home, and therefore impacts their readily available equity.

- Home loan Recommendations: Render your existing home loan harmony, monthly premiums, and leftover financing term.

- Debt-to-earnings Ratio: Calculate your bills, as well as car and truck loans, playing cards, and college loans, versus your income. Try using a proportion below 43 percent.

Exactly what are the Costs and you will Charges out of a shared out-of Omaha House Equity Line of credit?

- Rates of interest and you may Apr: Shared out-of Omaha Home loan also offers aggressive interest rates, being normally variable and you may in accordance with the You.S. Primary Speed. The apr (APR) makes up about desire or any other charges, taking a total view of the brand new loan’s prices.

- Application and you will Origination Charges: When you sign up for good HELOC, you will be billed initial software fees. Such fees coverage the expenses associated with control and underwriting the financing. On the other hand, if your HELOC is approved, you are able to bear origination fees – as well as prices for document planning, money and you may financial affairs (when the relevant).